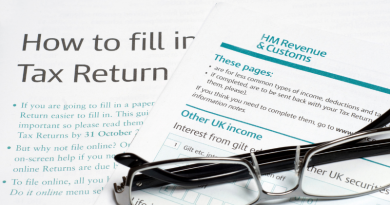

Struggling to pay tax – what should you do?

The January self-assessment payment deadline is not well timed… when people may be already struggling to pay their Christmas bills. However unpalatable the 31 January tax deadline is, it is not one that should be ignored.

Read More