Domestic Reverse Charge – say what now?

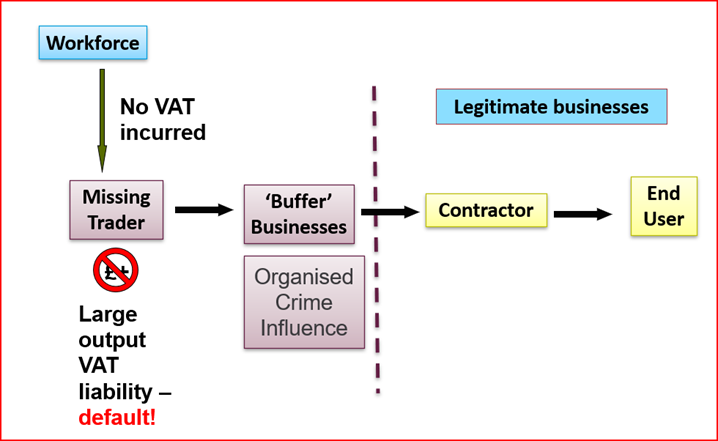

In March 2021, the VAT position changed as far as certain construction services are concerned with the introduction of Domestic Reverse Charge (DRC). So what led to this momentous change? HMRC has bought about this change in a response to sustained criminal attacks of stealing public money through missing trader fraud. They calculate that this will prevent losses estimated at £100 million per year. The DRC is already in place in 18 EU member states for various goods and services.

The diagram below show how missing trader fraud works.

The customer will account for the VAT rather than the supplier by doing a reverse charge entry on their own VAT return. This means that as the supplier you will neither charge VAT nor collect it from the customer. No VAT payment is made by the customer to the supplier hence a reduction in gross payments being received by the supplier.

What services will the charge apply to?

Only supplies of “specified” services will be subject to the reverse charge. Services supplied to non-construction businesses, such as a high street retailer, having their premises improved or any other end user customer or building owner are exempt from the new rules. It is only supplies between construction businesses that are caught.

The reverse charge will also apply to any goods supplied by a builder as part of their work. Supplies between landlords and tenants are excluded from the reverse charge as well as supplies involving connected parties. In such cases, the supplier will continue to charge VAT as happens now.

What services covered by the reverse charge?

The services that will be covered by this are described as construction services based on construction operation for CIS purposes, and will include the following:

- Constructing, altering, repairing, extending, demolishing, or dismantling buildings or structures (whether permanent or not), including offshore installation services.

- Constructing, altering, repairing, extending, demolishing of any works forming, or planned to form, part of the land, including (in particular) walls, roadworks, power lines, electronic communications equipment, aircraft runways, railways, inland waterways, docks, and harbours.

- Pipelines, reservoirs, water mains, wells, sewers, industrial plant, and installations for purposes of land drainage, coast protection or defence.

- Installing heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems in any building or structure.

- Internal cleaning of buildings and structures so far as carried out in the course of their construction, alteration, repair, extension or restoration.

- Painting or decorating the inside or the external surfaces of any building or structure.

- Services which form an integral part of or are part of the preparation or completion of the services described above. This includes site clearance, earth-moving, excavation, tunnelling and boring, laying of foundations, erection of scaffolding, site restoration, landscaping and the provision of roadways and other access works.

What service are excluded from reverse charge?

There are a number of exclusions from reverse charge VAT and these include:

- Drilling for, or extracting, oil or natural gas.

- Extracting minerals (using underground or surface working) and tunnelling, boring, or construction of underground works, for this purpose.

- Manufacturing building or engineering components or equipment, materials, plant or machinery, or delivering any of these to site.

- Manufacturing components for heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems, or delivering any of these to site.

- The professional work of architects or surveyors, or of building, engineering, interior or exterior decoration and landscape consultants.

- Making, installing and repairing artworks such as sculptures, murals and other items that are purely artistic.

- Signwriting and erecting, installing and repairing signboards and advertisements.

- Installing seating, blinds and shutters.

- Installing security systems, including burglar alarms, closed-circuit television, and public address systems.

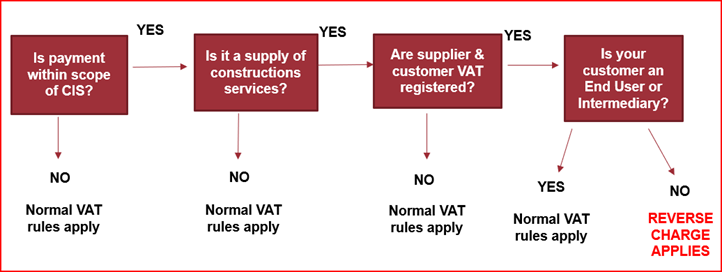

Here is a simple flow charge that will help you decide whether you need to apply the reverse charge to you invoice.

To avoid complications with different VAT elements on the same invoice if any of the goods supplied are subject to reverse charge this should be applied to the entire invoice, this does differ from CIS treatment, so be mindful of this.

What amount of VAT the customer must account for?

The reverse charge will be based on the rate of VAT that applies for the work in question but only supplies subject to either 5% or 20% VAT are affected, zero-rated work is therefore excluded. The same principles will apply to retention payments paid to suppliers of construction services, the reverse charge will apply if the supply relates to a specified service.

NB: Employment businesses are excluded from the new rules, so you will continue to charge them VAT as normal after 1 March 2021. An employment business is making supplies of staff rather than construction services.

What steps should you take if you supply construction services?

Checks should be applied to ensure that building contractors being invoiced under the new reverse charge rules are properly registered for VAT and are bona fide. You should consider asking new customers to provide details of their registration as a contractor for CIS purposes.

When it comes to your business records, sales invoices should include a reference to “reverse charge” so that the customer knows they must account for output tax with the appropriate calculation. The amount of VAT should be shown on the invoice or at least the rate of VAT that applies in each case.

It must be extremely clear that the supplier is not charging VAT, and HMRC’s guidance suggests including the phrase: “Reverse charge: customer to pay the VAT to HMRC” on any such invoices. Xero allows for different invoice templates so I would suggest setting one up specifically for this purpose.

If a customer informs you that they are not subject to the reverse charge, they need to confirm this in writing so that you can charge VAT in the standard way.

HMRC suggests that, if there are any doubts about the credentials of a customer, for example if they state that they have registered for VAT but not received a VAT number yet, a deposit equal to the amount of output tax not being charged should be collected. This is to cover you if the new rules don’t apply, as HMRC will seek to collect the VAT due from you, not the customer.

Taxpayer Impact

There will be an impact on the cashflow of businesses making reverse charge supplies as they will no longer collect the VAT on their sales invoices thus reducing the cash received into their business. Affected businesses may go from a payment to a repayment on their VAT returns, as a result. To help manage cash flow it may help affected business to file monthly VAT returns.

Reverse Charge VAT Return Entries

The entries for your VAT return will look slightly different for both reverse charge sales and purchases, and will impact the following boxes on your return:

Supplier

Box 1 – nothing is entered here.

Box 6 – enter the net value of the supply.

Customer

Box 1 – Enter the amount of VAT due as if it were a sale.

Box 4 – Enter the amount of VAT reclaimed, reverse VAT recoverable.

Box 6 – Nothing to enter as no sales has been made.

Box 7 – Enter the net value of the purchase.

HMRC has set up a specific email address to support business who have further questions surrounding this issue, it is Indirecttax.vatsncfteam@hmrc.gov.uk

Originally posted 2021-04-29 12:03:50.

- The importance of planning and budgeting - February 6, 2026

- Are you tax aware? - December 25, 2025

- Domestic Reverse Charge – say what now? - November 6, 2025