What the hell are balance sheets and profit and loss accounts?

If you run a business you may know that a balance sheet and profit and loss account form part of your year end accounts prepared by your accountant (especially if you run a Limited company). To many people, they are just numbers on a piece of paper they get given from their accountant each year and they do not really understand them.

I am going to take you through the basics of what they are and what information they provide.

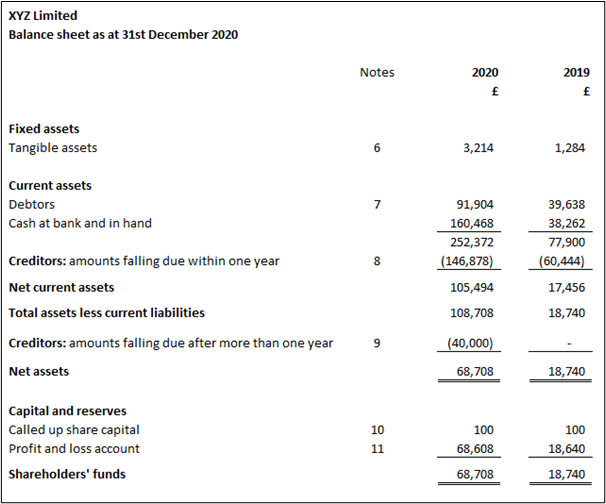

What is a balance sheet?

A balance sheet gives you a snapshot at a given point in time, usually on your year end, of everything your business owns and everything your business owes.

What is included in a balance sheet?

Assets

The top part of the balance sheet shows the business assets – the things your business owns.

These are split into two main headings:

- fixed assets: These are things the business will own for a long time such as buildings, equipment, computers and motor vehicles.

- current assets: These are things the business owns which convert into cash much quicker such as stock held for resale, unpaid sales invoices and bank balances.

Liabilities

The middle part of the balance sheet shows the business liabilities – the things your business owes.

These are again split into two main headings:

- amounts due under one year (also called current liabilities): These are items that the business is due to pay within the next year. This might include invoices outstanding for goods, Corporation Tax/PAYE/VAT not yet paid to HMRC, bank overdrafts, bank loans etc.

- amounts due after one year (also called long term liabilities): These are items that the business is due to pay in more than a year’s time. These will be items such as bank loans.

There will then be a couple of totals:

Net current assets/liabilities: This is calculated as current assets less current liabilities. This shows what is left over if you converted all your current assets to cash and used that cash to pay off your current liabilities.

Net assets/liabilities: This is calculated by adding together ALL assets and deducting ALL liabilities. This figure gives you as the business owner how much the business is worth on paper if you sold everything you own and paid off everything you owe.

Capital and reserves

The bottom part of the balance sheet shows what is available to the owners/shareholders of the business and where this has been generated from.

The most common headings are:

- Called up share capital: This is the amount the shareholders have put into the company for purchasing their shares (if a Limited company).

- Retained earnings: This is the amount of profits/losses generated after tax to date left to be distributed to shareholders or the owners of the business.

OR

- Owners funds: If you are a sole trader or a partnership you will see owners funds which will be a combination of capital introduced, drawings taken and profits/losses generated.

The total here should equal the net asset/liability position – the reason it is called a balance sheet!

Here is an example of a typical balance sheet for a small limited company:

The notes will provide additional information about what makes up the balances on the balance sheet.

What does a balance sheet show?

By looking at a balance sheet you can get a good idea of a business’s financial position.

You will be able to see whether the business is asset rich or cash poor or highly reliant on business loans to fund the business.

The balance sheet can be used to:

- Let investors decide whether your business is risky and if can afford to repay debts.

- Help credit agencies/suppliers generate a credit score for the business

- Help value the business if you were to decide to sell the business.

If you run a Limited company the balance sheet for your business is available to view by anyone on Companies House if they search for it.

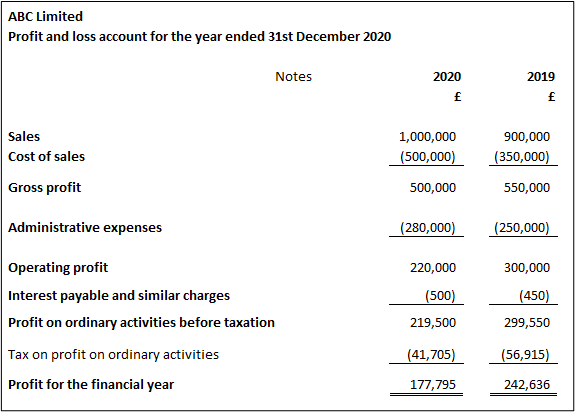

What is a profit and loss account?

A profit and loss (P&L for short) account summarises the income generated and expenses incurred by a business over a period of time (usually a year).

What is included in a profit and loss account?

Turnover

This may also be referred to as sales or revenue. This is the income generated by your business. This may be from selling products in a shop or online or it could be by selling your services.

Cost of sales

These are the costs incurred that directly relate to you making a sale.

A few examples could be:

- The cost of purchasing an item to resell

- The cost of purchasing the ingredients or components to make something else

- The staff costs for producing goods to sell

Gross profit

Gross profit is the difference between your sales and cost of sales. The gross profit figure is used to calculate a gross profit margin percentage which can be reviewed and compared. The gross profit margin shows you how much profit (towards overheads) your business is making for every pound of sales.

The gross profit margin is effectively your sales mark up or added value to a product and can highlight pricing issues or inefficiencies.

Understanding the effect of changes to sales or costs of sales on gross profit margins, will aid you in effectively monitoring the performance of your business.

Administrative Expenses

These may also be referred to as overheads. These are the expenses a business needs to incur to run regardless of how many sales are generated.

Examples could include:

- Rent, rates, electricity, insurance

- Telephone, internet, stationery

- Wages costs for admin staff

- Advertising, marketing, networking

Profit/loss before tax

This is the profit or loss generated after deducting all costs and expenses from sales. This figure is the starting point for which tax is calculated whether you are a sole trader, a partnership or a Limited company.

Here is an example of a typical profit and loss account for a small limited company:

What does a profit and loss account show?

Reviewing a profit and loss account will show whether the business has made a profit or a loss for the period being looked at.

Although the profit and loss account will show past information it can be used as a tool to review and plan for future periods.

A profit and loss account within a set of year end accounts will be quite simple and even a detailed profit and loss account showing more detailed breakdowns of the headings will only give you an indication as to the key areas of your income and costs. It may be whilst reviewing the figures that you will then need to drill into the transactional detail in order to get information to be able to fully review costs.

Both the balance sheet and profit and loss account are useful tools for reviewing your business performance and should be reviewed on a regular basis. If you are using an accounting software such as Xero then these reports are readily available to view at a click of a button as and when needed.

Find out more about how Canary Accounting can help you with your numbers

Originally posted 2021-01-04 15:12:50.

- Expenses – what can I get away with?! - December 26, 2025

- Making Tax Digital – unraveled! - November 5, 2025

- What the hell are balance sheets and profit and loss accounts? - August 5, 2025