Micawbering and insolvency – why you shouldn’t trust your break even point

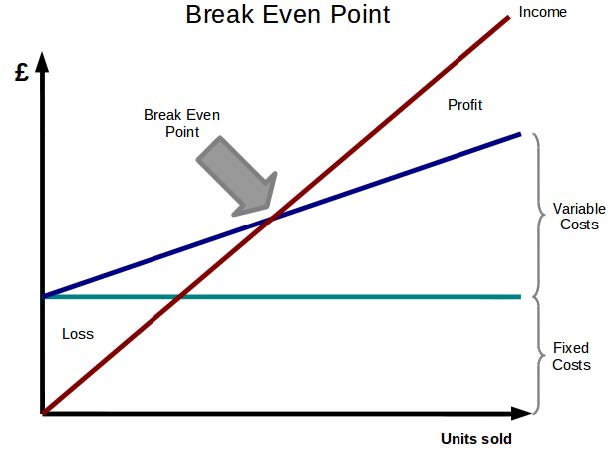

I assume you have already worked out your break even point (BEP). If not, you really should because it would be ill advised to run any business without knowing it. If you haven’t done it, go and do it now. Actually, more sensibly, read this article first and then go and do it. It’s not complex, it is the point where your revenue is the equal to your cost. In simple terms if it costs you £100 to run your business, then when your income reaches £100 you can put a tick against your break even. Clearly then it is a figure that every business should have a very clear understanding of because below that you are officially insolvent. Your income is lower than your outgoing costs which is where you are in serious trouble. As Charles Dickens so eloquently put it:

Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds and six, result misery.

Hardly rocket science is it? It stands to reason that if you earn more from your business than you spend on your business you are going to be OK. Well, possibly but this only a half truth. At the risk of being a bit of a cynic here it is probably worth remembering that the quote above is attributed to the character of Mr Micawber who was in debtors’ prison for not keeping up with his payments to creditors. Isn’t it odd that Mr Micawber could be so on the ball with his fiscal philosophy yet still not able to keep himself out of debt? Maybe it is because he is also known for his other approach to life which was that something ‘would always turn up’.

We see a lot of businesses on the verge of insolvency and it is not uncommon for part of the problem to be that they have ‘Micawbered’, to coin a phrase. They have focused only on the break even point and the result is that their business is in debt beyond redemption. Like Micawber they have been labouring under the belief that any amount above your base income line is enough and, as long as you hit that, then something will turn up to keep your business going.

This article is about how to work out a more practical break even point and avoid the mistakes people often make when working the numbers, by looking realistically at what it all actually means.

The ‘formula’ for a break even line

Whatever your business there will always be a series of fixed costs. These will be the obvious list of things that you must pay on a regular basis. Usually they will be a mixed bag of the following:

Fixed costs, i.e. things that rarely change, such as

- Rent

- Agreed monthly cost for utilities or services

- Insurance

- Rates

And so on. These will vary depending on your business of course but whatever they are you will be able to predict them clearly and account for them easily.

Variable costs, i.e. things that change or vary according to the circumstances of business, such as

- Cost of labour

- Material used

- Consumables

- Variable utilities

- Shipping and logistics

And many others. Some of these you will be able to isolate and predict with some accuracy and others you may need to be a little more pragmatic about.

The formula then is to take your fixed and variable costs and use them to work out how much you must sell to break even. So, if you manufacture widgets that sell for £1 each and your monthly overheads are £10,000 then you need to manufacture and sell 10,000 widgets to break even. If you are someone who provides a service and your overheads are £2500 a month then the sale of your ‘time’ needs to add up to £2500 worth of income (see figure 1).

Right?

Well, no, not really. In fact, that kind of thinking is sometimes one of the causes of financial problems within a business. The issue with looking at things based on your BEP is not so much that there is anything wrong with using it as a benchmark, it is more what it is a benchmark of. We often see businesses that use the BEP as a kind of badge of honour. It’s as if the break even point is a measure of success and it isn’t.

The break even point is a measure of survival.

Thinking realistically about break even points

Firstly, there is nothing wrong about being an optimist about your business as long as you are using a healthy dose of reality to keep it in check. Micawbering, as we said earlier, is just making enough above your BEP in the belief that something will turn up soon. The fact that you are pennies above your BEP is not something to be celebrated. It means you are always working on the edge. That your business is simply moving from one moment of treading water to the next and never really swimming in the full pool. In fact, the swimming pool analogy works really well here. Rather than thinking about your BEP as the point at which you are not drowning (hooray!) think of it as the deep-water line (woah!) beyond which you are in danger. Sometimes we see people in real financial trouble who will tell us ‘but I was usually above the BEP’ and in fairness they probably were. This is because treading water and surviving is only fine until you get an unexpected current that pushes you out of your depth.

As well as the BEP being an unsuitable measure of success it is sometimes unreliable. If you get the numbers wrong, it can be misleading, and break even is a very dangerous place to be misled. Fixed costs are easy but variable costs are more difficult. If things get difficult a forgotten variable, even a small one, can be the difference between solvent and insolvent. It is really important that you put a good buffer amount into your variables to account for the unexpected.

What is the alternative to focusing on BEP?

Let’s be clear, nobody is suggesting that you don’t bother with the BEP because you must know where you stand against cost. Try looking at things differently though. Instead of your break even being your benchmark aim higher and go for an upper BEP. Make this a target figure that covers your costs, a comfortable amount for the business to have in the bank and pay your personal income. Make you’re your effective BEP. Worry when you drop below it. If you are in manufacturing, look to every aspect of your cost and sales and work on making them pay your upper BEP. If they aren’t doing that then do something about it quickly. If you are in the service or consultancy areas, you may also want to give more focus to the hours taken to achieve your financial goals as well. I know several businesses where the owners spend 12 hours a day on their business and walk away happy because they are hitting the break even point. Sorry, but when you stand back and look at that from the outside, what they are doing is working unreasonable hours to achieve a survival level. Using a higher, more realistic BEP, that allows you to work a reasonable number of hours and take a reasonable living makes much more sense, doesn’t it?

Now, just for balance, a little splash of cold water on the upper BEP approach. If you hit your lower break even point a few times it is probably not the end of the world. With COVID-19 and other factors a lot of people are occasionally punishing the credit cards or having a slow month. In difficult circumstances, when everything is against you and you should be failing, to survive is a win. Right now, we all need a win. However, if you find that you are dipping below the break even point and then returning to it on a regular cycle, it is strong indicator of trouble ahead and you should act. Get advice and take stock of where you really stand. Under no circumstances fall into the trap of Micawbering repeatedly in the hope that something will turn up to lift you above it. Nothing may turn up and if it does turn up it may not be a good thing. If it is an unexpected bill from HMRC or some other aggressive creditor, you could be in real trouble.

BEPs can lull you into a false sense of security and have a siren call of false hope that will put you on the rocks. Treat them as a warning and they will become far more useful.

Originally posted 2020-11-05 15:32:49.

- Micawbering and insolvency – why you shouldn’t trust your break even point - July 23, 2025

- Bankrupt, insolvent or in need of rescue? - June 13, 2025